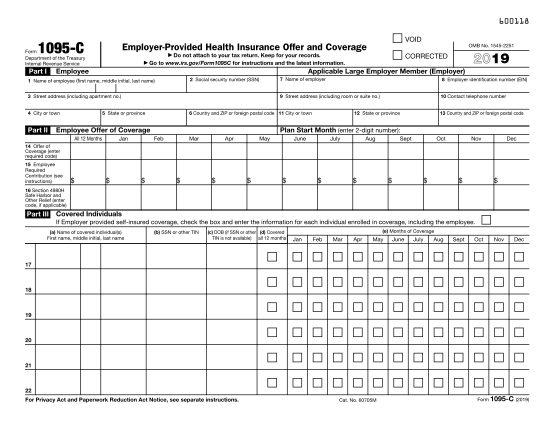

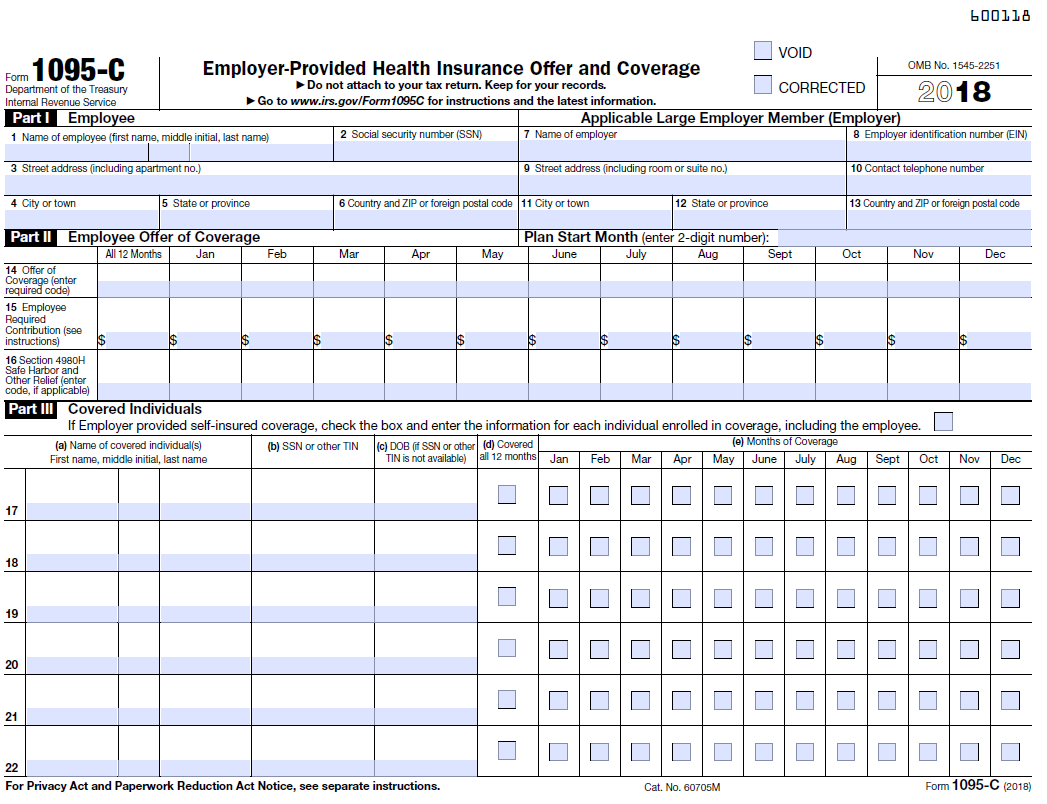

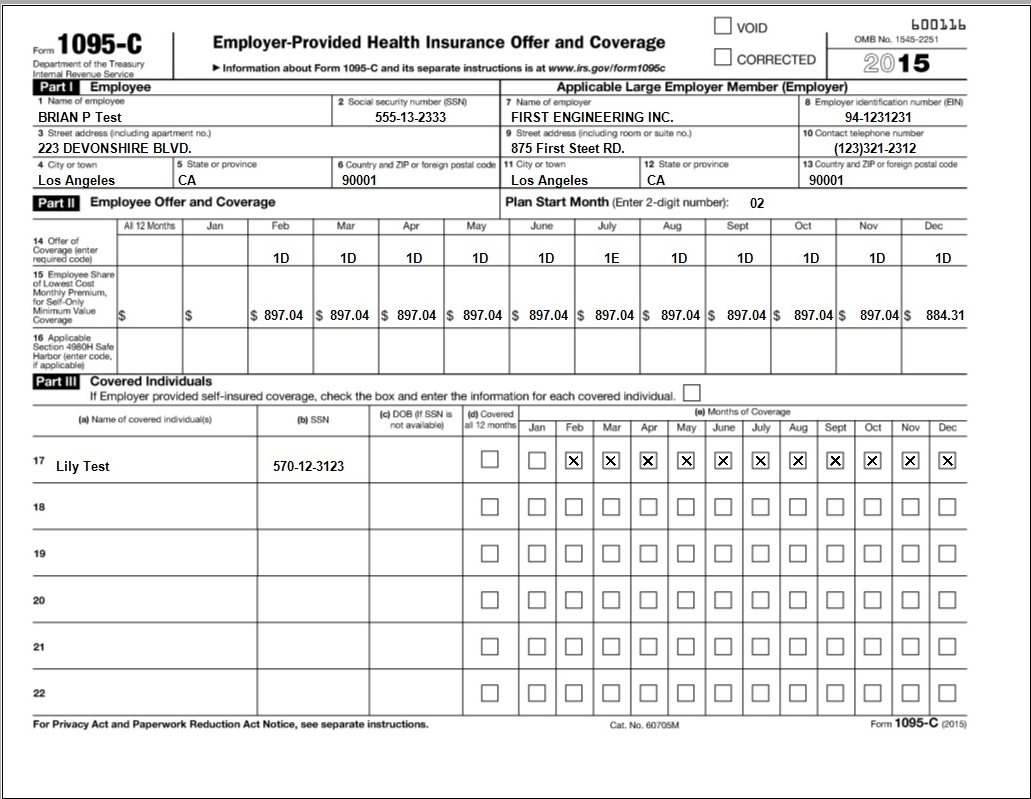

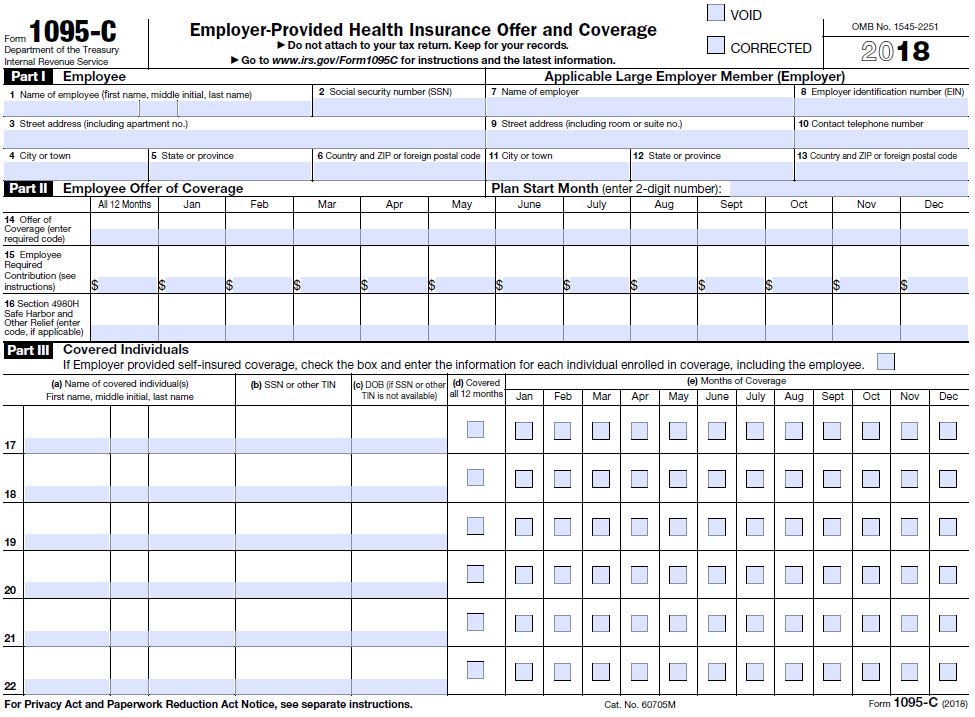

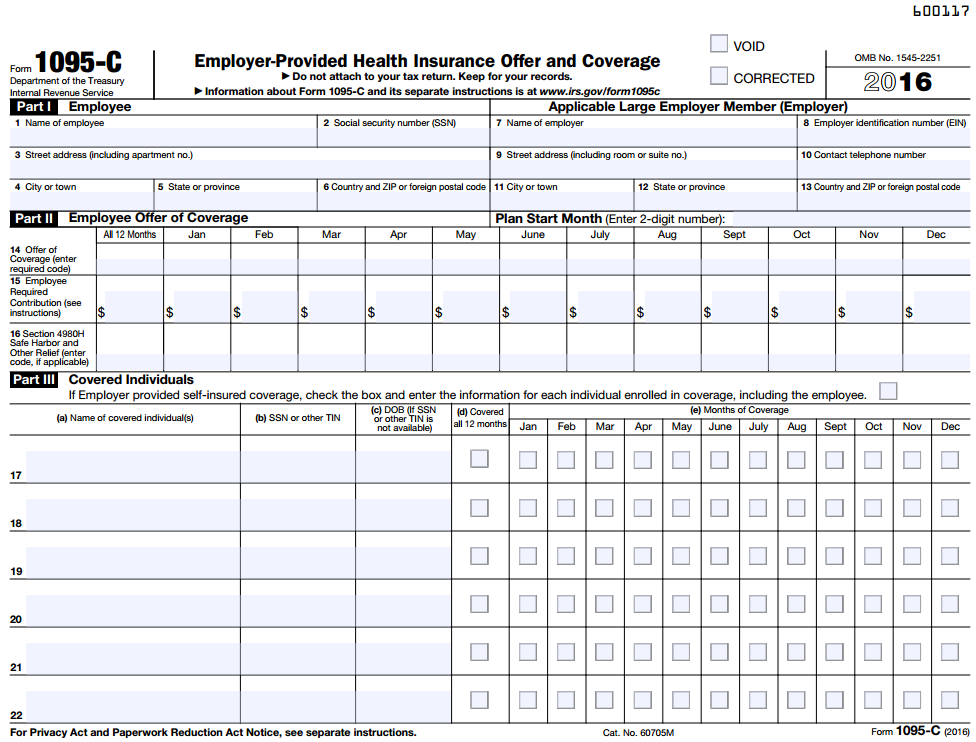

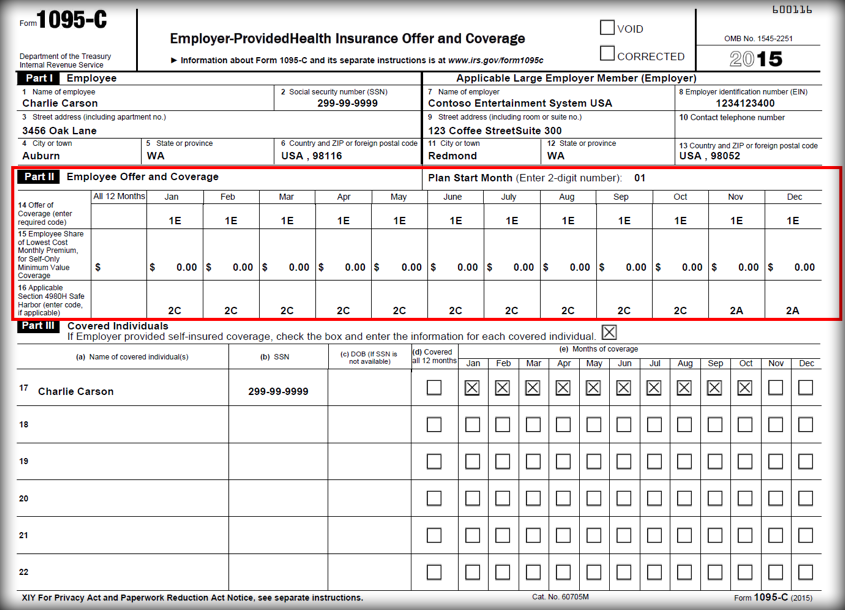

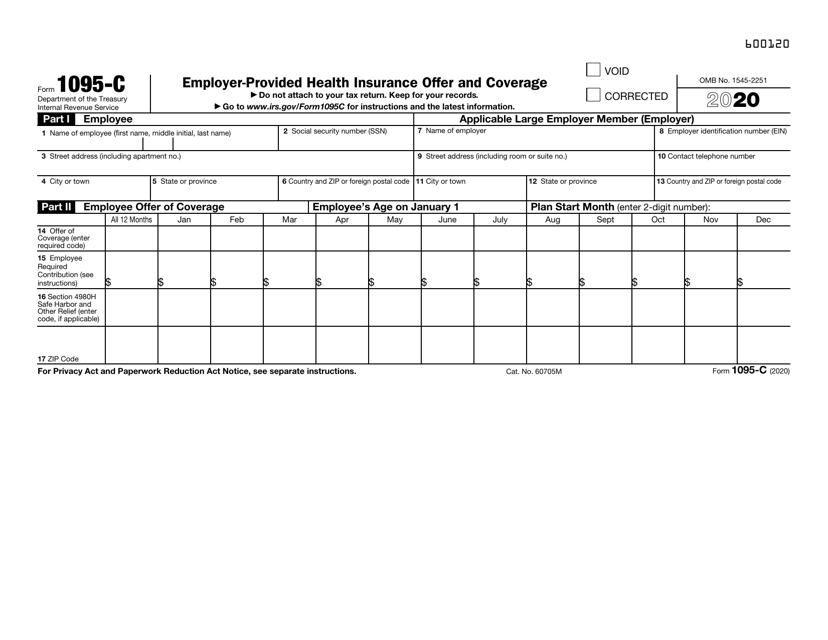

The Affordable Care Act (ACA) requires nearly all Americans to have health insurance The 1095C statements that will be generated by the State of North Carolina serve as documentation to the IRS about coverage offered to you The form includes information about offers of health insuranceNo M Form 1095C (18) As illustrated in the image, the 1095C form is made up of 3 parts Part I (Lines 113) provides information about the employee and the employer6 rows1218 Form 1094C (18) Page 2 Part III ALE Member Information—Monthly (a) Minimum

Blog Form 1095 C

1095 c form 2018 downloadable

1095 c form 2018 downloadable-Form 1095B Form 1095B is sent out by health insurance carriers, governmentsponsored plans such as Medicare, Medicaid, and CHIP, and selfinsured employers who aren't required to send out Form 1095C instead This form is mailed to the IRS and to the insured member If you buy your own coverage outside the exchange, you'll receive FormWho will send my Form 1095C?

1

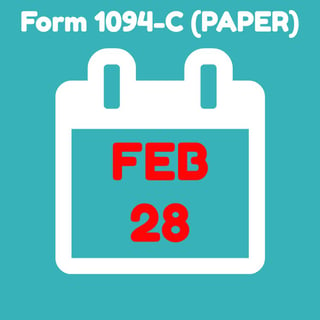

The 18 Form 1094C and all supporting Forms 1095C (collectively, "the return") is due to the IRS by if filing electronically (or if filing by paper) These deadlines were not extended as part of the relief announced in Notice 14You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, PartForm for your 18 tax records What is a Form 1095C?

A8 Since the deadline was extended to March 2, 18, you most likely will not be in receipt of Form 1095C when you file your taxes It is not necessary for you to wait for receipt of Form 1095C in order to file your taxes The information on Form 1095C is not requiredC for Covered Individual Box 1 6 Employee CharacterBy putting to use CocoSign, you can fill in 1095 C Form 18 and include your digital signature immediately It will definetely amplify your productivity and make your life much easier Thousands of companies love CocoSign

Form 1095B Health Coverage Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095A Health Insurance Marketplace Statement 21 Inst 1094C and 1095C Instructions for Forms 1094C and 1095CYou will only receive a Form 1095C from your employer if you worked 30 hours/week for that employer, or you worked hours/week and enrolled in the RCAB Health Plan at that employer For example, if you worked 30 hours/week for a parish, and another 10 hours/week for a school in 18, you will only receive a 1095C Form from the parish 5The forms and instructions are largely unchanged from 17 The Plan Start Month box continues to be optional on Form 1095C for 18 Parts I and III of Form 1095C include separate fields for each individual's first name, middle initial, and last name, rather than a single blank for the individual's full name

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

Sample 1095 C Forms Aca Track Support

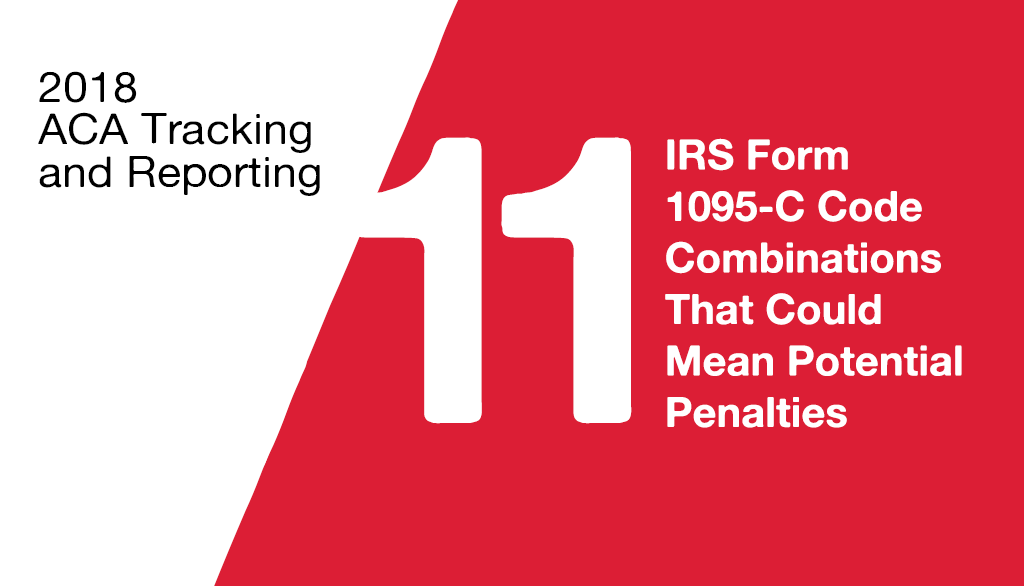

Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit18 Form 1094C/1095C Instructions – Penalties for reporting failures and errors will increase to $270 per violation up to an annual maximum of $3,275,500 Please note Penalty limits apply separately to IRS information returns and individual statements Form 1095C must be sent out to employees byThe due date is February 28, 18;

Files Nc Gov

It S Year End Time Again Are You Gp Payroll Ready Erp Software Blog

Are obligated to issue and file the 18 AA information returns Other than some formattingWhat to Do With Your 1095 Forms Form 1095C is sent to those who worked fulltime in 18 for what the IRS calls "an applicable larger employer" That means an employer with 50 or more fullAbout Form 1095C, EmployerProvided Health Insurance Offer and Coverage Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

Irs Extends Aca Deadline For Providing 1095s To Employees For 18 Psst

18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 100 Employees Personnel Forms Office School Supplies

The new 18 version of Form 1094C and Form 1095C are available at these links 18 Form 1094C 18 Form 1095C The IRS has also issued the filing schedule for ACA reporting for the 18 tax year As to whether or not any extension for the furnishing and filing deadlines will be available is yet unknownRecipient fields common to all form types Record Type 1 Text Record Type is a required field and it indicates if a record is the Responsible Individual/Employee Use E for Employee/Responsible Individual &18 Form 1095C Author SEWCARMP Subject EmployerProvided Health Insurance Offer and Coverage Created Date 12/6/18 PM

18 Form 1095 C Mailed February 19 Human Resources The University Of New Mexico

18 Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 Personnel Forms Office Products

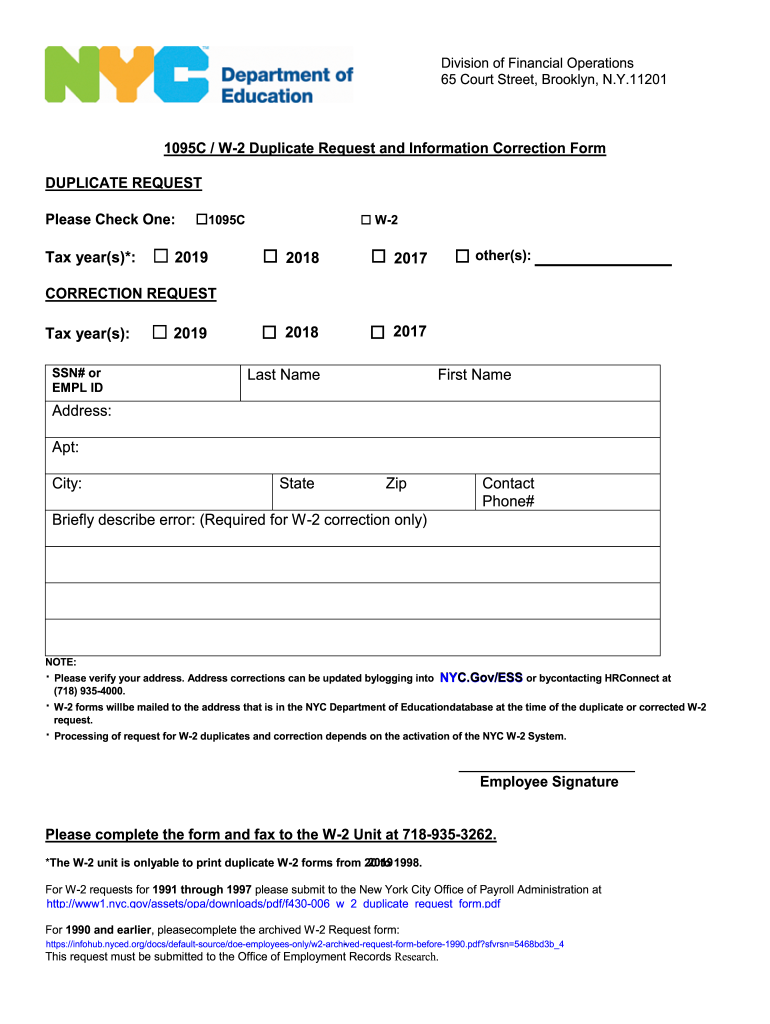

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingPlease ask your tax advisor if you have questions about how to incorporate the 1095C information into your tax filing for the year 18 If information on your form is incorrect such as address or social security number please contact Human Resources orIn IRS Notice 14, the IRS announced an extension for furnishing 18 IRS Forms 1095B (Health Coverage) and 1095C (EmployerProvided Health Insurance Offer and Coverage), from , to The IRS issued this extension in response to requests by employers, insurers, and other providers of health insurance coverage that

Amazon Com 18 Complyright 1095 C Employer Provided Health Insurance Form Pack Of 500 Office Products

Blog Form 1095 C

October 18 The Internal Revenue Service ("IRS") has released the final 18 version of the Affordable are Act ("AA") Information Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹1943 Draft 19 Forms 1095B and 1095C have no substantial changes from 18 On , the IRS posted on its website draft IRS Form 1095B, Health Coverage and draft IRS Form 1095C, EmployerProvided Health Insurance Offer and Coverage, which are used to report information required by the Affordable Care Act (ACA) to theForm 1094B Transmittal of Health Coverage Information Returns Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only)

Import Spreadsheet Format Guidelines For Tax Year 18 Boomtax

Good News Irs Extends 1095 C Reporting Deadline And Good Faith Transition Relief For 18 Reporting Erp Software Blog

Home 18 1095C Codes 18 1095C Codes For more information on how we can support your ACA reporting needs click here any month for which the ALE member checked the " No " box on Form 1094C, Part III, column (a)) For more information, see the instructions for Form 1094C, Part III, column (a)Form 1095C, Employer Provided Health Insurance Offer and Coverage provides coverage information for you, your spouse (if you file a joint return), and individuals you claim as dependents had qualifying health coverage (referred to as 'minimum essential coverage) for some or all months during the year NoteEmployers are required to furnish only one Form 1095C for all individualsFulltime equivalent employees of ALEs should receive Form 1095C from their employer When will I receive Form 1095C?

Sample 1095 C Forms Aca Track Support

2

18 Form 1095C (employee statement) Due 18 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) If the due date falls on a weekend or legal holiday, theIf filing electronically, the due date is April 2, 18 As a result of these extensions, individuals might not receive a Form 1095B or Form 1095C by the time they file their 17 tax returns For more information, see Notice 1806 Read the entire IRS Notice 186The draft 19 versions of Form 1094C and 1095C are also available for download at the following links 19 Draft Form 1094C 19 Draft Form 1095C While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACA

2 Minute Tax Topics Form 1095 C Health Insurance Coverage Youtube

18 Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 Personnel Forms Office Products

1095 c instructions 18;Form 1095C is intended to include all the necessary information to allow the recipient and/or the tax preparer to properly complete and file the recipient's tax return All applicable large group employers 18 The IRS 1094 transmittal submission deadline remains March 31st, 18Form 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No 18 Part I Employee 1 Name of employee (f

1095 C Form 18 Brilliant 1095 C Form 18 Q Posts Document Design Ideas Document Design Ideas Models Form Ideas

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Software

When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C also is used in determining the eligibility of employees for the premium tax creditIn the coming weeks, you may receive a tax document called the 1095C that will contain detailed information about your healthcare coverage if you were eligible in 18 While you will not need to include your 1095C with your 18 tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Irs Form 1095 C Uva Hr

15 rows18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1095C, steer clear of blunders along with furnish it in a timely manner How to complete any Form 1095C onlineChanges to the Form 1094C There are no other substantive changes to the Form 1094C Deadlines As of now an employer will have to furnish the 18 Form 1095C to certain employees by The Form 1095C is by far the more complicated Form and providers who are not automating the process will undoubtedly struggle to meet this

Ac1095e300 18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 100 Employees

19 Aca Reporting Timeline Pomeroy Group

Employers are required to send Form 1095C for the 17 tax year by March 2, 18 What should I do if I don't receive a Form 1095C or if I lose my form?Form 1094C gets auto generated based on the 1095C forms input inside the system This saves users time and simplifies the filing process As an employer you can think of the 1095C as the W2 form of ACA healthcare reporting and 1094C as the W3 transmittal of ACA reporting And the due dates are also similarSelf‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18

1

2

You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, PartExtended Deadline to Furnish 18 Forms 1095C to Employees IRS Notice 14 announced an extension of the deadline to furnish Forms 1095C to employees until , but employers are encouraged to furnish such statements as soon as possible The extension is automatic and does not need to be requestedALE Member and to transmit Forms 1095C to the IRS Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C also is used in determining the eligibility of

New 1095 C Form 18 Models Form Ideas

Irs Extends Deadline For Furnishing 18 Forms 1095 To Individuals And Good Faith Transition Relief Health Employment And Labor

The Internal Revenue Service (IRS) created Form 1095C to serve as that statement The Affordable Care Act, or Obamacare, requires certain employers to offer health insurance coverage to fulltime employees and their dependents

trix Irs Forms 1095 C

3 1095 C Form Free To Edit Download Print Cocodoc

Changes Coming For 1095 C Form Tango Health Tango Health

New 1095 C Form 18 Models Form Ideas

The Individual Mandate May Be Going Away Next Year But Employers Are Still On The Hook For 1094c 1095c Reporting Usi Insurance Services

Form 1095 A 1095 B 1095 C And Instructions

2

1095 C Employer Provided Health Insurance Offer 500 Sheets

1

Ny 1095c W 2 Duplicate Request And Information Correction Form 19 21 Fill Out Tax Template Online Us Legal Forms

Amazon Com 18 Complyright 1095 C Health Insurance Offer And Coverage Form Portrait Format Employer Employee Copy Laser Pack Of 500 Office Products

1

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

2

Irs Extends Deadline For Employers To Furnish Forms 1095 C And 1095 B Johnson Dugan

2

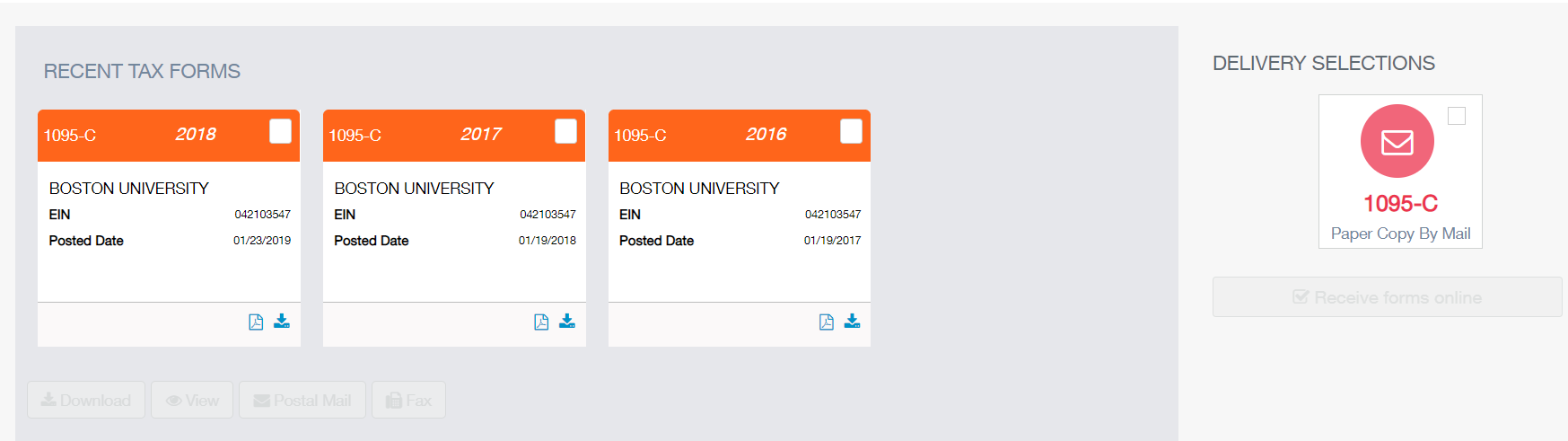

Electing To Receive Your 1095 C And W 2 Forms Electronically 19 Social Security Wage Base Increase Uf At Work

1095 C 18 Public Documents 1099 Pro Wiki

1095 C Print Mail s

More Time To Distribute Your Forms 1095 C Again This Year Graydon Law

Irs Form 1095 C Fauquier County Va

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2

Accurate 1095 C Forms Reporting A Primer Integrity Data

How To Help Employer Clients With Irs Letter 226j Benefitspro

18 Complyright 1095 C Employer Provided Health Insurance Form Psycholoogravels Be

Irs Extends Due Date For Employers To Issue Health Coverage Forms In 18 News Illinois State

Accurate 1095 C Forms Reporting A Primer Integrity Data

Tax Time Approaches Do You Know Where Your W 2 Or 1095 C Forms Are Montgomery County Public Schools

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

1095 C Form Official Irs Version Discount Tax Forms

Code Series 1 For Form 1095 C Line 14

Irs 1095 C Form Pdffiller

The Irs Wants To Know Has Your Company Filed Form 1095 C

Tax Forms 1095 A 1095 B 1095 C Business Benefits Group

Aca Reporting Deadlines For 18

Form 1095 A 1095 B 1095 C And Instructions

18 Complyright 1095c Irs Employer Provided Health Insurance Form Pack Of 100

Egp Irs Approved Blank Laser 1095 Aca Form With Back Instructions For Use With 1095 B Or 1095 C Quantity 100 Tax Forms

1095 C 16 Public Documents 1099 Pro Wiki

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Setting Up Aca Form 1095 C Reporting In Dynamics Ax 12 And D365 In The Know Solutions Group

Kanagaandassociates Co Ke Pack Of 500 1095cirs500 18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form Laser Cut Sheet Landscape Irs Copy Office Products Office Supplies

2

Form 1095 A 1095 B 1095 C And Instructions

3

Mmeht Org

2

Annual Health Care Coverage Statements

Accurate 1095 C Forms Reporting A Primer Integrity Data

Hawaii Edu

2

News Flash Team Plano Tx Civicengage

Aca Extensions 1095 C Employee Form Deadline And Good Faith Effort Tango Health

2

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Your 1095 C Tax Form My Com

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

What Is A Tax Form 1095 A And How Do I Use It Stride Blog

1095 C Form 18 Check Your Free Word Now Cocosign

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Form 1095 C Guide For Employees Contact Us

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

2

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Amazon Com 18 Complyright 1095 C Health Insurance Offer And Coverage Form Portrait Format Employer Employee Copy Laser Pack Of 500 Office Products

Updated Irs Reporting Requirements Babb Insurance

Do Dependents Spouse Need To Be Reported On 1095 C Forms

Amazon Com 18 Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 1095cirsamz Office Products

18 Complyright Form 1095 C Health Coverage Forms And Envelopes With Aca Sof Ebay

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

Aca Reporting In 18 Need To Know Items Narfa

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

2

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Your 1095 C Tax Form For Human Resources